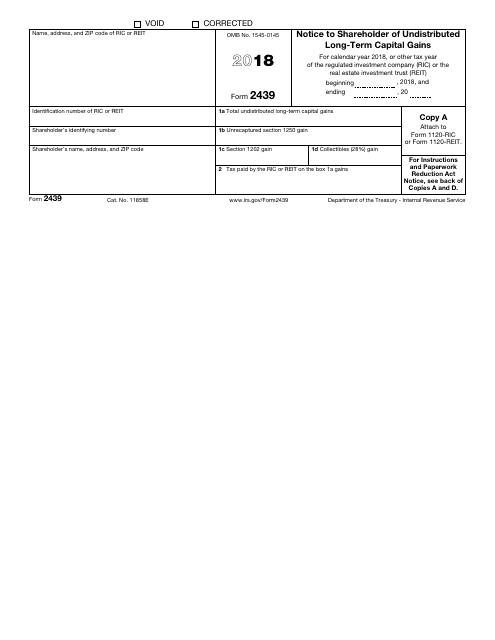

What Is Form 2439 Used For

Form 2439 is an irs form that mutual funds must send to their shareholders to inform them of undistributed capital gains and taxes paid on those gains.

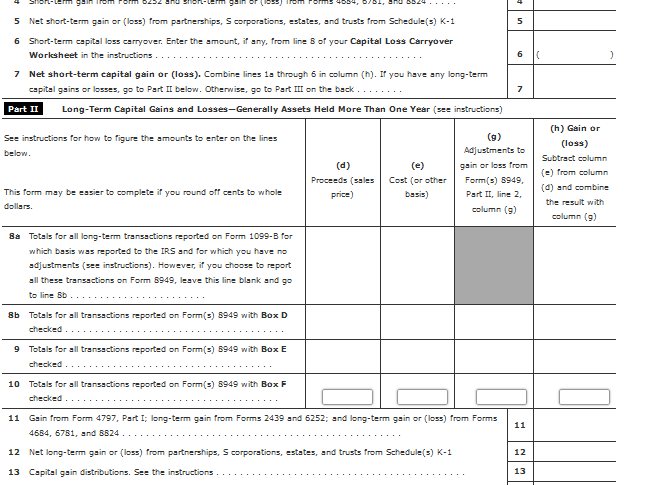

What is form 2439 used for. Copy d is to be kept for the ric s or riet s record. Information about form 2439 notice to shareholder of undistributed long term capital gains including recent updates related forms and instructions on how to file. Shareholders also receive copies of form 2439. Line 4 form 2439 notice to shareholder of undistributed long term capital gains enter an amount.

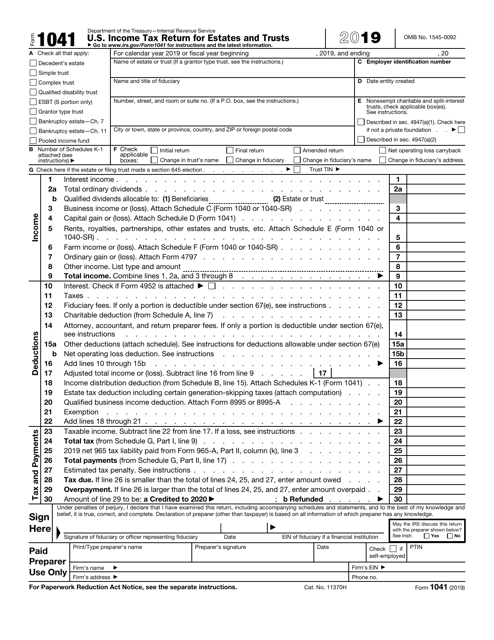

A separate form 2439 will be issued for each investment. These forms will be issued 90 days following the fiscal year end of the ric or reit. Form 2439 a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Form 2439 notice to shareholder of undistributed long term capital gains reports to owners of regulated investment companies rics and real estate investment trusts reits undistributed capital gains allocable to them.

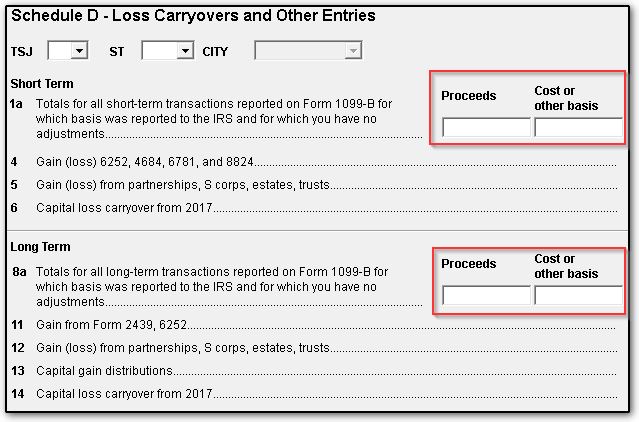

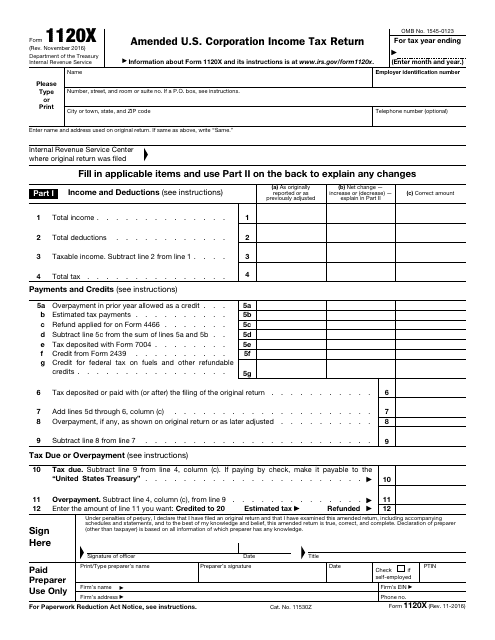

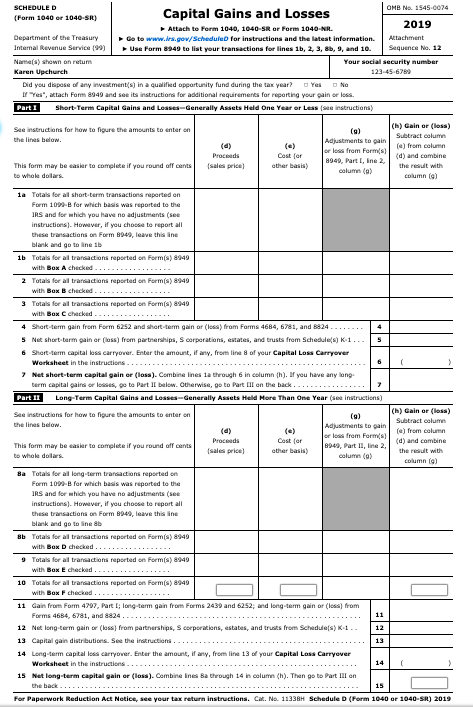

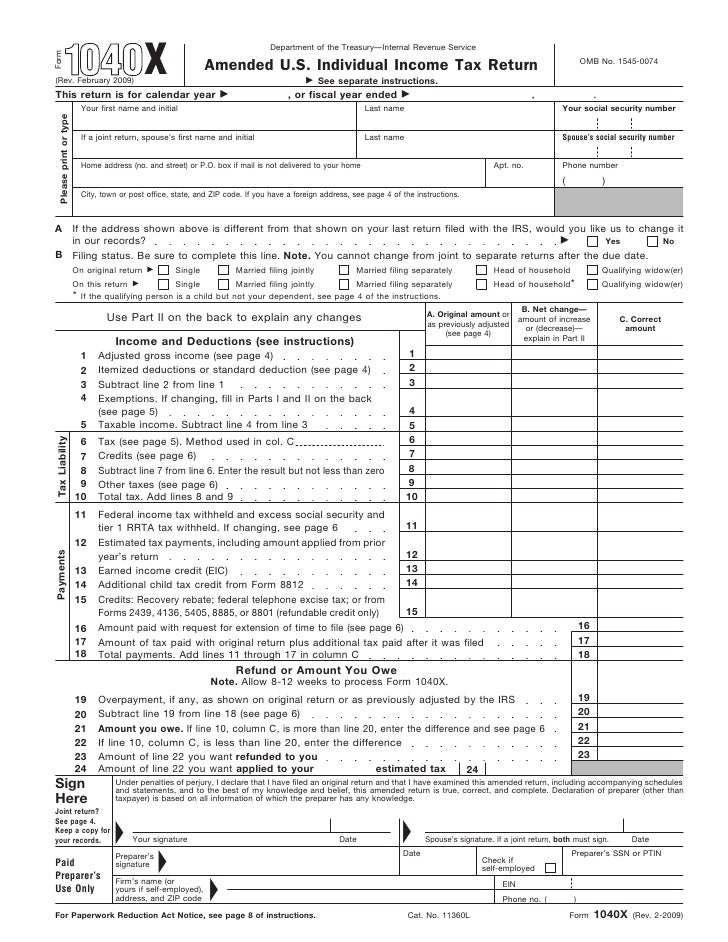

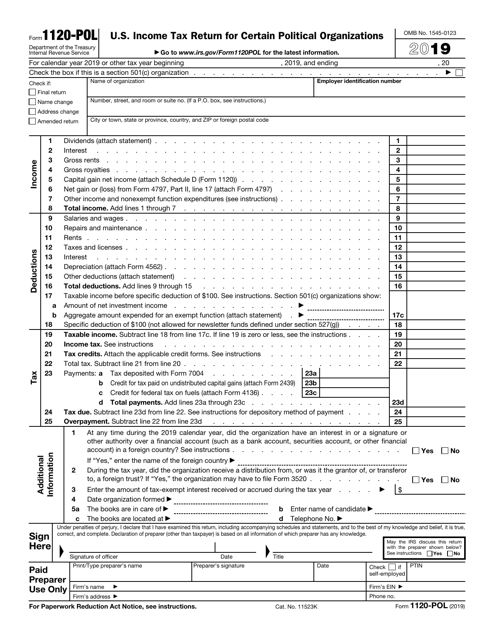

Copy a is to be completed and attached to irs form 1120 ric or 1120 riet. The capital gains will flow to the schedule d. This form consists of four copies. Undistributed capital gains form 2439 a mutual fund usually distributes all its capital gains to its shareholders.

The mutual fund company reports these gains on form 1099 div. Irs form 2439 is a notice to share holder of undistributed long term capital gains. Copy b and c are to be furnished to the shareholder. 2012 farlex inc.

The amounts entered in boxes 1b 1c and 1d and the tax shown in. The total undistributed long term capital gains entered in box 1a. The above information will flow to. Form 2439 notice to shareholder of undistributed long term capital gains is the form required to be issued by regulated investment companies rics and real estate investment trusts reits when there have been undistributed long term capital gains.